Anne-Marie C. Dingemans, MD, PhD

Editor’s Note: This is one of two articles exploring the implications of financial toxicity in lung cancer in today’s edition of ILCN. Read the other article here and look for more on this subject in the coming months. You can also learn more by listening to IASLC’s podcast on the subject.

“Financially, I had to give up so much. I feel punished that I got sick.”

That’s one of the responses from a lung cancer patient in an online questionnaire from NFK, the Dutch Federation of Cancer Patient Organizations.1

This patient’s experience is not unique.2 Almost 80% of the lung cancer patients who responded to the questionnaire indicated that they experienced increased expenses and/or less income after diagnosis. However, to date, most health care providers in a country with well-organized healthcare like the Netherlands have not considered that patients will experience such financial distress. In this article, we describe the patient-level impact of the cost of lung cancer—what we call “financial toxicity.”

Jente Klok, MSc

Before we describe the patients’ experience around lung cancer costs, first a little background on how the healthcare system in the Netherlands is financed. Common medical care is covered by basic health insurance, which is mandatory by law for all Dutch residents. Almost all the health insurance companies in the Netherlands are not-for-profit cooperatives that allocate any profits they make to the reserves required to maintain or return lower premiums for the Dutch inhabitants.3 Because basic insurance is required by law, health insurers cannot decide to refuse insurance for a patient, regardless of the patients’ health background.

Standard treatments for lung cancer are reimbursed by this basic insurance. This includes all costs for medical interventions and treatments approved by the ministry of health, wellbeing and sports of the Netherlands.4 Taken all together, you do get a sense that patients in the Netherlands should not have to worry about their lung cancer healthcare costs.

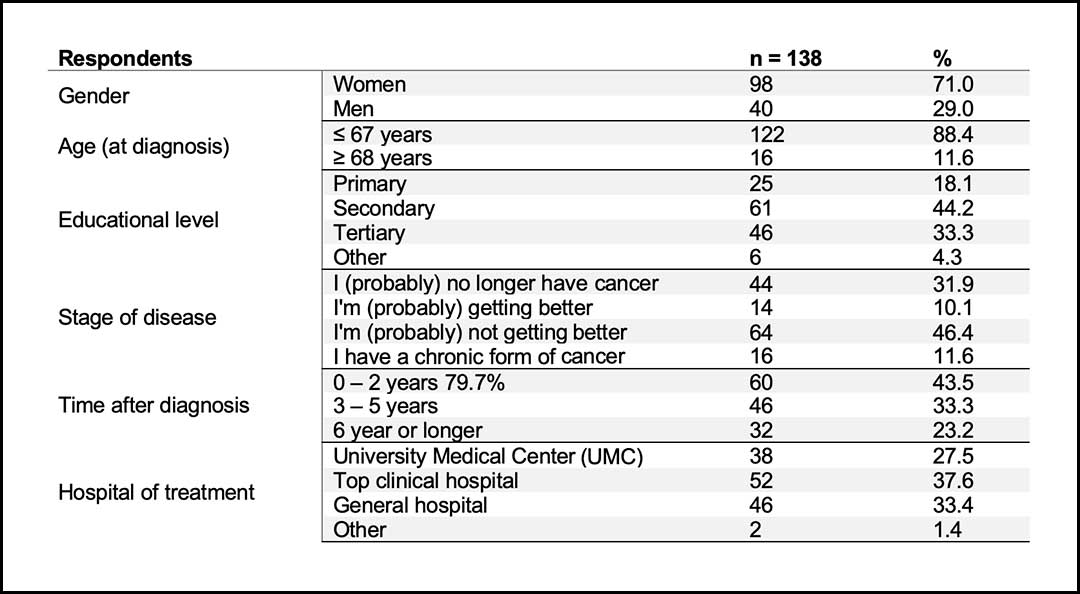

However, the patient’s perspective demonstrates otherwise. In October 2021, the NFK sent out a questionnaire to Dutch patients with cancer. Of the 4,675 respondents, 138 were patients with lung cancer.1 Table 1 shows the demographics of the group of lung cancer patients who responded to the questionnaire. Of the lung cancer patients who responded to the questionnaire, 79.7% said they experienced increased expenses and/or less income after diagnosis.

Before the diagnosis of lung cancer, a small proportion of lung cancer patients (3.6%) found it difficult or very difficult to make ends meet. A worrying finding is that one year after diagnosis, 16.0% indicated that it was difficult or very difficult to get by. The diagnosis of cancer therefore makes, for a fair part of the patient group, the difference between being able to remain financially stable or not.

Figure 1 visualizes this founding shift in financial stability.1

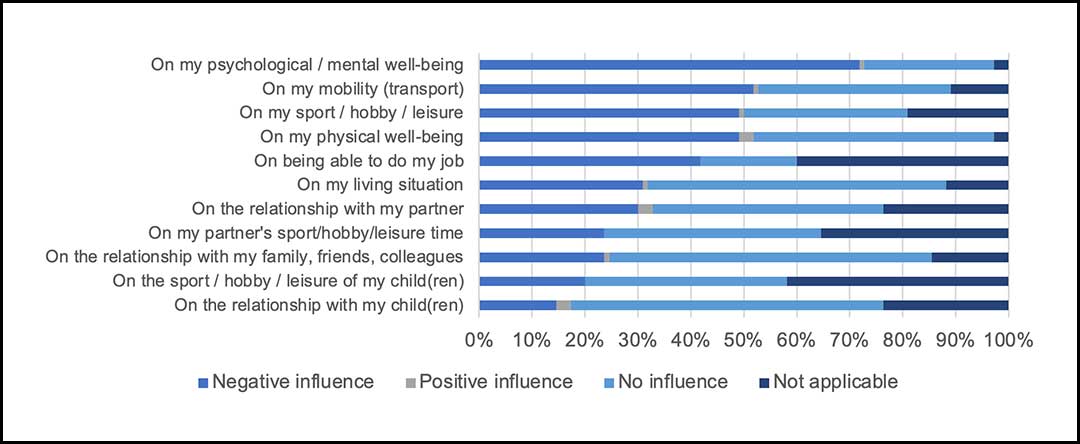

This shift in financial stability influences the patients’ well-being. Figure 2 shows the negative impact of the financial consequences of having lung cancer on a patient’s well-being. Of the lung cancer patients who responded to the questionnaire, 71.8% reported a negative influence on their psychological/mental well-being, and 49.1% said they experienced a negative influence on their physical well-being.

Vivian Engelen, PhD

So why are insured patients with lung cancer facing financial toxicity? It’s easy to see that loss of income plays a significant role.

One respondent said: “Due to the loss of income, we can no longer do many things. Buying clothes, day trips, gifts for children or grandchildren. It’s all no longer possible!”

Lung cancer mainly has financial consequences for people who are still working, according to the NFK. Some patients can no longer work at all because of their illness. Others may work intermittently or work fewer hours than before their diagnosis.

In the Netherlands, we have a social safety net that, in the event of illness, allows people to retain 70% of their income for the first two years. A higher percentage (90% or 100%) is often agreed in collective labor agreements for the first year of illness.

Lidia Barberio, MSc

However, not everyone is protected by this safety net. For example, entrepreneurs and freelancers do not qualify and therefore must rely on their own savings after income loss.

The extent of financial hardship will differ for each individual, regardless of whether they are an employee or an entrepreneur. However, in this patient group, the majority of the lung cancer patients have metastatic lung cancer, and the loss of income will likely become permanent. It therefore makes sense as a care provider to inquire about this aspect of their lives and to provide information for help where necessary.

A more complex reason patients with lung cancer experience financial toxicity are the increased out-of-pocket expenses that are part of treatment. Examples of out-of-pocket costs include travel and parking costs, deductibles, and treatment-related items such as remedies for cancer sores or calming tablets.

All of these factors, though treatment-related, are not reimbursed by insurance. Of respondents, 57.3% stated they experienced increased out-of-pocket costs for care after diagnosis, and of those patients, 75% said the extra expenses were permanent.

Roel Masselink, MSc

The results suggest that lung cancer patients are dealing with additional financial challenges as a part of their cancer experience, even though all patients in the Netherlands are insured for medical costs. In fact, these out-of-pocket expenses related to treatment might have a high impact on patient quality of life.4 The greater the financial impact, the greater the impact on daily life, according to this poll.1

Not all patients will experience the same financial burden. Previous research found that younger patients and those with lower income, are more likely to be predisposed to greater financial burden.6 In addition, other sociodemographic characteristics, including type of insurance, race, marital status, education, geographic location, and comorbidity, might contribute to higher out-of-pocket expenses. The NFK outcomes show that we should not underestimate the financial impact of a disease like lung cancer and that we need to acknowledge that cancer can put people in a difficult situation financially.1

Information and financial support can help prevent or reduce financial difficulties. A joint task force in the Netherlands is bringing together patient care and support organizations, budget and debt counseling services, and government agencies to combine resources to help cancer patients confronting financial toxicity.

We can all agree that the fear and worries that patients already have about their disease is more than enough.

References

- 1. NFK Questionnaire Report

- 2. Shankaran V, Li, L, Fedorenko C, et al. Risk of Adverse Financial Events in Patients With Cancer: Evidence From a Novel Linkage Between Cancer Registry and Credit Records [published online ahead of print, 2022 Jan 7]. J Clin Oncol., 20220;JCO- JCO2101636. doi:10.1200/JCO.21.01636.

- 3. National Health Care Institute: The Dutch Health Care System

- 4. Hendriks LE, Dingemans AM, De Ruysscher DKM, et al. Lung Cancer in the Netherlands. J Thorac Oncol, 2021;16(3):355-365. Doi:10.106/j.jtho.2020.10.012

- 5. Zafar SY, Abernethy AP. Financial toxicity, part I: a new name for a growing problem. Oncology (Williston Park). 2013;27(2):80-149.

- 6. Shankaran V, Jolly S, Blough D, Ramsey SD. Risk factors for financial hardship in patients receiving adjuvant chemotherapy for colon cancer: a population-based exploratory analysis. J Clin Oncol. 2012; 30:1608–1614. doi:10.1200/JCO.2011.37.9511